Menu

Explore HACCP certification in India for ensuring food safety through systematic hazard analysis and control measures. Learn about compliance standards.

Explore HACCP certification in India for ensuring food safety through systematic hazard analysis and control measures. Learn about compliance standards.

Sometimes nobody raises their hand and says, “I’ll take charge of this project.” And suddenly, you realize… you’re the one coordinating meetings, nudging teammates and secretly panicking about the deadline.

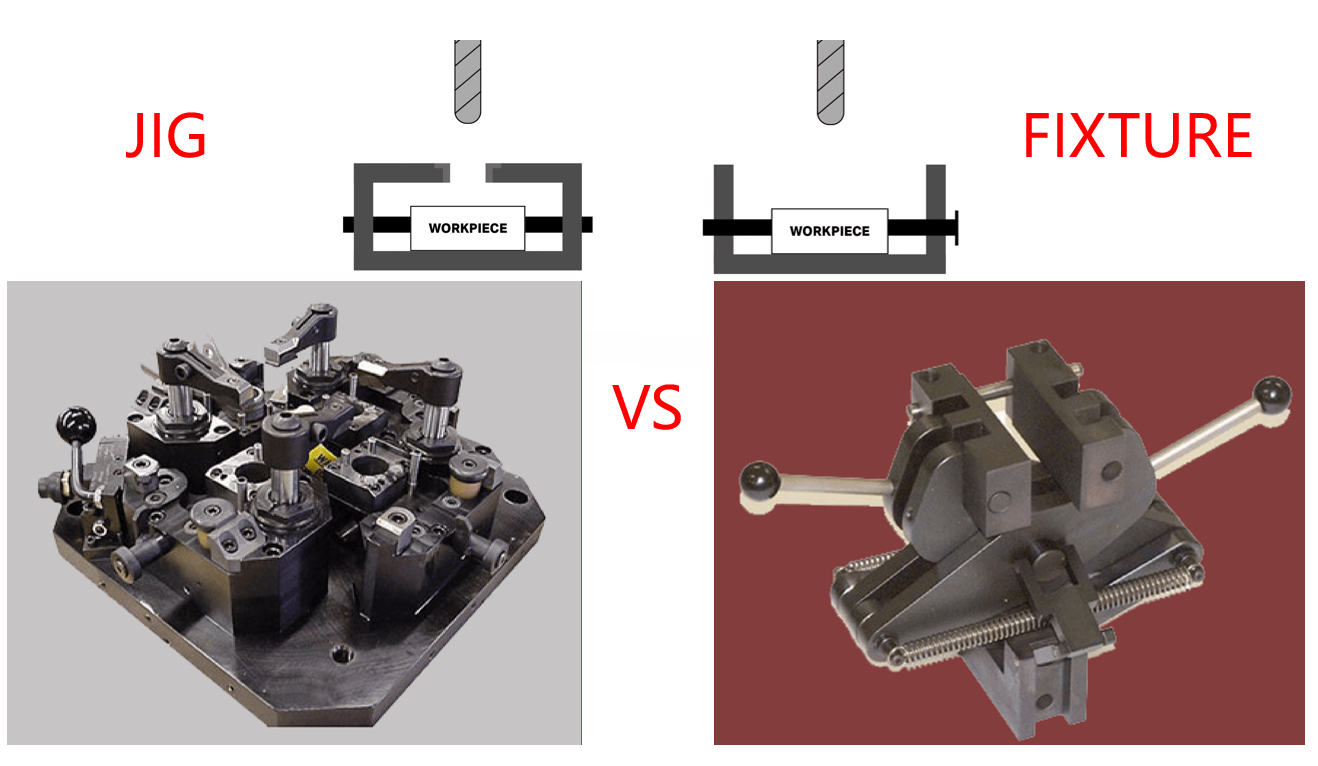

This guest post explains how jigs and fixtures improve CNC machining accuracy, stability, and repeatability. It covers workholding tools, CNC fixture design, machining support tooling, and precision locating devices, showing how proper tooling supports efficient, high-quality, and scalable CNC production.

Corteiz is the British Streetwear Clothing Brand. More than 30% off on the Corteiz online Store. Fast Shipping Worldwide.

Discover how a Shopify automation service improves control, scalability, and decision-making—and what most sellers overlook about automation.

We hope this read was helpful to you! Don’t forget to follow Guest Genius Hub for more relevant and informative content!