Menu

7D car floor mats offer a stylish and practical solution to enhance your car’s interior. Custom-fit and made from high-quality materials, these mats protect your car’s floors from dirt, moisture, and damage while adding a sleek, polished look. Car mats manufacturers provide a wide range of options to suit every vehicle and style, ensuring your car stays clean, comfortable, and stylish for years.

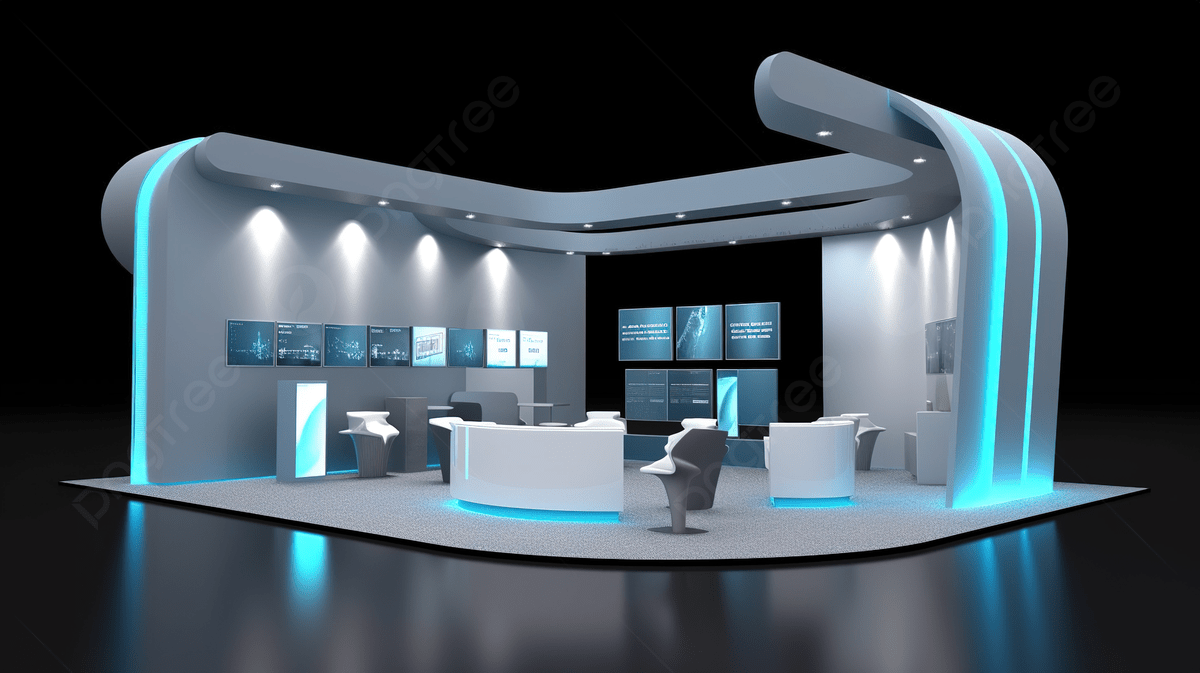

Exhibitions and trade shows are bustling hubs of activity where brands compete for attention and engagement. In Frankfurt, a global epicenter for exhibitions like Ambiente, Automechanika, and Paperworld, the stakes

In today’s digital age, partnering with a professional digital marketing agency can be the key to business success. In Pakistan, especially in Islamabad, digital marketing agencies are helping brands boost their online presence through strategies like SEO, social media marketing, and PPC campaigns. Whether you’re a small business or a large corporation, a reliable digital marketing company can take your brand to the next level by driving traffic, increasing sales, and enhancing customer engagement. This excerpt gives readers a quick overview of the article while incorporating the key ideas!

Common Signs Your Home Needs Foundation and Structural Repairs in AL Your home’s foundation is its backbone, providing stability and support for the entire structure. However, foundation problems can arise

Best Massage Outcall in Bangkok, delivery To Your Home / Hotel / Condo. Similan Thai Massage, The best Massage Outcall in Bangkok, We provide girls massage outcall Bangkok 24/7 by our professionally trained masseuses.

In the ever-evolving world of fashion, where trends shift with the seasons, some collaborations stand out as truly transformative. The partnership between Sp5der and Comme des Garçons is one such

We hope this read was helpful to you! Don’t forget to follow Guest Genius Hub for more relevant and informative content!