The insurance landscape continues to change at breakneck speed toward accessibility, speed, and customer experiences that are more personalized. Traditional approaches to purchase and the administration of insurance are being surpassed by digital at an increasing rate, with insurance app development services in the lead. These enable insurers to offer a hyper-tech customer base what they want: seamless, proficient ways to engage with their insurance providers.

Background: The Need Comprehended for Apps for the Insurance

In today’s fast-moving world, the customer wants everything to be convenient. Insurance certainly is no exception. Gone are the days when customers spent hours over the phone or sat in branch offices maintaining their policies or filing claims. They now want everything at their fingertips. It is this paradigm shift of customer behavior that actually makes app development services a necessary addition if company leaders really want to work at their competitive best within the insurance industry.

The objective of designing insurance apps is to put all services, ranging from policy management to claim processing, under one umbrella. Such apps not only smooth operations for the insurance companies but also increase customer satisfaction. It’s through the digital interface that insurers can provide real-time access to customer policies, instant quotes, and quick processing of claims—powerful factors in customer satisfaction and building brand loyalty.

Basic Features of Contemporary Insurance Applications

Building a competent insurance application demands a good understanding of the insurance business as well as mobile technology. A number of the important features that are typically found integrated into the application include :

1. User Experience Interface

On the other hand, an excellent user interface design is the backbone of any app’s success. It means that an intuitive kind of navigation system is developed with the view that users can find whatever they want without much fuss. Policy details, everything starting from should be on their fingers within a few taps to making a claim.

2. Personalized Experience

Today’s consumers expect services that are tailored to them in order to meet their specific needs. Insurance apps use data analytics to provide a policy, reminders for premium payments, and custom notifications, all personalized for a customer’s needs. While this hyper-personalization makes the user experience even more convenient, at the same time, it is another way for the insurance company to upsell customers with additional services.

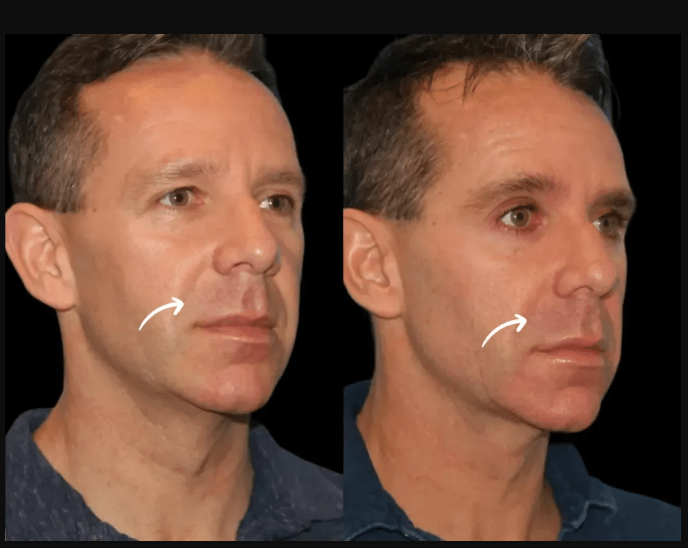

3. Secure Transactions

Security is a key consideration for insurance apps given the nature of data they handle. The application should have features like fingerprint and facial protection, encryption, and two-factor authentication to safeguard the information and ensure user trust is held in high regard throughout the process.

4. Instant Claim Processing

One of the most loved features of any insurance app is its claim filing facility. Apart from making the process of filing claims faster and easier, customers can simply take photos of their documents to upload; monitor the status of their claims in real-time; and get payouts quicker than any other way of traditional processes.

5. 24/7 Customer Support

Insurance companies are continuously implementing AI-powered chatbots within the core of their apps to provide customers with constant service, literally 24/7. These chatbots are intelligent enough to handle simple queries, guide users through the process, and hand off whatever issue is beyond them to a human representative.

Impact of Insurance Apps on Customer Satisfaction

The convenience and efficiency the insurance apps provide directly influence customer satisfaction. Since clients can easily access information and services, a sense of control on matters relating to their insurance is felt. This makes trust a substantial selling factor in the insurance industry. Moreover, they deal with everything from their mobile devices, which helps in saving them from the waits and all the hustle; the experience in total becomes a lot better.

Benefits to the Insurers

The main intention of insurance applications is to improve the customer experience. However, insurance companies are still benefiting a lot from insurance apps. Here is how:

1. Operational Efficiency:

The automation of operations, such as claims processing, updating policies, and customer service, reduces the burden of human agents. It not only cuts costs but also releases employees to focus on more technical issues that require personal handling.

2. Data Collection and Analysis:

Insurance applications create a data minefield that organizations can mine for the purpose of refining their products or services. Through the evaluation of the behavior of customers, insurers should be able to determine trends, risks, and develop offerings that may require change so as better to meet the desires of their clients .

3. Competitive Advantage

In such competitive business areas like insurance, a company having a well-thought-out functional app is likely to stand out. Customers will choose that insurer who can offer them a mobile app as a convenience opposed to any other that doesn’t.

4. Cost Reduction

Digitization helps insurance companies cut their operational costs enormously. It makes the whole range from policy management to customer support less costly, leading to great savings in the final account.

Challenges in Insurance App Development

Though many benefits come with the development of an insurance app, there indeed are some challenges, some of which are as below:

1. Regulatory Compliance

The regulatory environment in the insurance industry is robust, and the complexity to ensure that an app is compliant with its requirements does not present a light burden. This necessitates a close collaboration with the relevant legal experts to stay up to date with the latest requirements.

2. Security Concerns

The Security of sensitive customer information is paramount. The developers must ensure that the insurance app is thoroughly protected and a vigilant sight maintained in the face of threats.

3. Integration with Legacy Systems

A lot of these insurance companies still use very old legacy systems that were not meant for technology advancement. Integrating a new app with these old systems and others is going to cost them millions. The app may need investment in its infrastructure again.

The Future Landscape: What’s Next for Insurance Apps?

The future of insurance app development looks bright. Tech will advance further, and we can witness more features being introduced in these applications. Artificial intelligence and machine learning, for example, will be applied to a higher extent—thus, making it possible for apps to deliver even more personalized services with predictive analytics.

Besides, the development of wearable technology will offer the insurance companies another opportunity to gain valuable data, considering that a proper product roll-out occurs with this development. For instance, health insurers could someday give insurance discounts based on fitness activity data.

Conclusion: The Digital Future Means Life

Insurance app development services do not only sound like a trend but are the future of insurance services. As customers demand more digital solutions, insurance companies must move along with these needs. With app development, insurers can ensure increased customer satisfaction, smoothen their operations and have a cutting competitive edge in an evolving market at rates that are evolving. The journey can be quite long to digital transformation, but the future does look quite bright for the insurance sector with the right tools and strategies.